For years, giant cryptocurrency exchange Binance has had a reputation for dodging regulators and circumventing financial rules, all with little consequence.

Now the world’s largest crypto exchange is under increasing legal pressure.

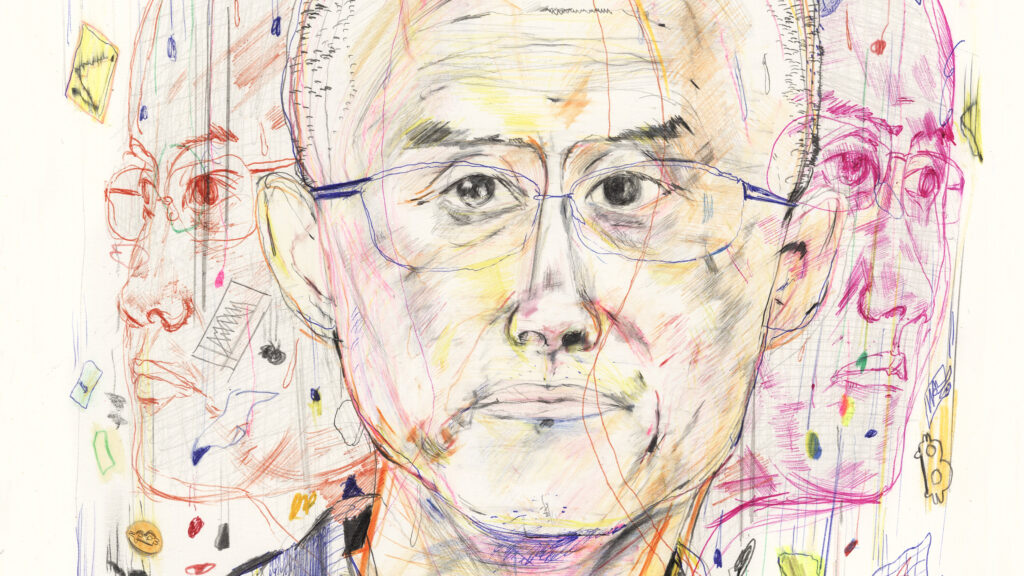

Changpeng Zhao, Binance’s founder and CEO, has hired corporate lawyers from law firm Latham & Watkins to represent him personally as he and his company face a tightening legal web. Prosecutors for the Justice Department are investigating the exchange for money laundering violations, while the Securities and Exchange Commission is investigating the company’s business practices. Last month, another agency, the Commodity Futures Trading Commission, sued Mr. Zhao, alleging compliance violations that allowed criminals to launder money on Binance.

The legal threats have converged to create the most precarious moment in Binance history. Criminal charges against Mr. Zhao or his company could spark a stampede in crypto markets, which have been reeling from last year’s collapse of the FTX exchange and the arrest of company founder Sam Bankman-Fried. Binance is many times larger than FTX and processes tens of billions of dollars in trades every day.

“It’s the biggest exchange for crypto, and if it’s shut down, it’s going to be a big deal,” said Hilary Allen, a crypto expert at American University. “It’s hard to imagine the rest of the crypto industry remaining unscathed.”

Mr. Zhao, 46, has responded by hiring compliance officers with government IDs and pledging to help law enforcement crack down on crypto crimes. Binance executives are meeting with reporters to trumpet the company’s compliance efforts, and the exchange’s US arm has formed a political action committee to advance its agenda in Washington.

Mr. Zhao called the CFTC lawsuit “unexpected and disappointing” and described it as “an incomplete representation of facts.” A company spokesman declined to comment on the further investigation. Officials from the Justice Department, the CFTC and the SEC also declined to comment.

The increasing pressure on Binance has already sent tremors through the crypto market. The exchange’s US operations recently lost a key banking partner, Signature Bank, when the embattled lender went out of business last month. Binance also lost its external auditing firm Mazars last year after the company announced it would stop working for crypto clients. (The spokesman said Binance hired new accounting firms but refused to identify them.)

Some Binance customers seem scared. According to crypto data tracker Nansen, more than $2 billion worth of cryptocurrencies based on the popular Ethereum network were delisted in a seven-day period at the end of March. So far this month, nearly $1 billion has left the platform. Binance is still sitting on an estimated $66.5 billion in customer inventory, says Nansen.

The CFTC lawsuit was a wake-up call to the gravity of Binance’s legal position. The complaint, citing internal texts and emails, argued that the company had allowed criminals to launder funds. Some clients could bypass critical background checks, the complaint said, by using existing loopholes to receive the exchange’s profits. Binance employees secretly joked about terrorists moving money on the platform, acknowledging that the company “facilitates potentially illegal activities,” according to the CFTC in its complaint.

Aitan Goelman, a partner at law firm Zuckerman Spaeder who previously served as the CFTC’s enforcement director, said the extent of the behavior described in the lawsuit sets Binance apart from its crypto peers.

“The wrongdoing is so egregious that one would think the Department of Justice would be interested,” Mr. Goelman said.

The Justice Department’s criminal investigation is being led by its Money Laundering and Asset Recovery Division, three people familiar with the investigation said. Those officials are working with prosecutors at the US Attorney’s Office in Seattle, the people said, and the SEC has a parallel investigation. Details of the case were previously reported by Reuters.

Binance has a number of law firms orchestrating its defense. Mr. Zhao has hired at least four attorneys from Latham & Watkins, while the company was represented by half a dozen attorneys from Gibson Dunn in its discussions with the Justice Department and US regulators, according to court records and people with knowledge of the matter.

Founded in 2017, Binance grew rapidly, offering a marketplace for a wide variety of experimental cryptocurrencies and allowing customers to place a type of risky, heavily leveraged bet on crypto prices that remains illegal in the United States. According to CCData, a data analytics company, about two-thirds of all crypto trades take place on Binance’s platform.

In the crypto world, Mr. Zhao is just as famous and influential as Mr. Bankman-Fried before his arrest. But Mr. Zhao, better known in the crypto community as CZ, is an elusive figure.

Mr. Zhao, a Chinese-born Canadian national, has hopped from country to country and now splits most of his time between Dubai and Paris, according to a person familiar with the matter. Mr. Zhao traveled to the United States at least once in 2022, the person said.

Binance has long been dogged by allegations that it has circumvented global money laundering rules and attempted to circumvent regulations in the countries in which it operates. At times, the private exchange has operated out of China, Malta and Singapore; A spokesman said the company now has major regional offices in Dubai and Paris with 8,000 full-time employees worldwide.

Binance is not authorized to operate in the United States, so Mr. Zhao has a smaller company for American users called Binance.US, which says it operates separately from the global exchange. However, the company’s US-based customers were able to access the main platform via virtual private networks in order to disguise their whereabouts.

Binance has been under the supervision of US regulators for years. In February, Patrick Hillmann, chief strategy officer, announced that the exchange was in talks with regulators for an agreement to settle the various legal investigations with a fine or other penalty. He said the company is “very confident and feeling really good” about the talks.

A month later, the CFTC filed its lawsuit.

The agency sued Binance affiliates based in the Cayman Islands and Ireland, saying those companies are “directly or indirectly owned” by Mr. Zhao and linked to dozens of other business entities maintained by the exchange. The complaint stated that Mr. Zhao was personally responsible for Binance’s compliance violations and described a meeting in which he acknowledged the existence of a loophole that allowed users to bypass Know Your Customer protocols.

The CFTC also sued Binance’s former top compliance officer, Samuel Lim, alleging that he helped American clients circumvent systems designed to prevent money laundering. A lawyer for Mr Lim did not respond to requests for comment.

The lawsuit added that Binance allowed three unnamed American trading firms to operate on its platform, even though U.S. firms were banned from doing so. According to a person familiar with the matter, the firms were Jane Street Group, Tower Research Capital and Radix Trading. There is no indication that the companies previously identified by Bloomberg News are being investigated by federal agencies.

A spokesman for Jane Street declined to comment. Radix and Tower Research representatives did not respond to requests for comment.

Claims that Binance allowed the spread of money laundering also surfaced in some private lawsuits, several of which were dismissed in court. Some plaintiffs claim they were scammed by crypto traders who then funneled stolen funds through the exchange.

David Silver, a Florida attorney who sued Binance last year, said the CFTC lawsuit is likely the first of several lawsuits against Mr. Zhao’s firm.

“The truth will come out,” said Mr. Silver. “And Binance is found guilty.”

Binance’s spokesperson said the firm is “working closely with law enforcement to freeze funds identified as potentially illegally obtained.” Over the past year, Binance has helped law enforcement “thwart cybercriminals in over 40,000 cases worldwide,” he said.

Binance has attempted to build a more robust compliance infrastructure. The company now has a compliance department with more than 750 employees, the spokesman said, with hundreds hired over the past year. In January, a former federal prosecutor, Noah Perlman, was appointed as the new global compliance chief.

Binance has also recruited former law enforcement officials, including Tigran Gambaryan, a former Internal Revenue Service investigator who worked on several of the government’s high-profile early crypto cases.

In an interview, Mr Gambaryan said the allegations against Binance are a holdover from an earlier era when the exchange was a small start-up focused on growth.

Binance “sees itself as a tech company,” he said, adding, “They break things. All exchanges have made it.”

Source: US Today